10 Pennsylvania Salary Tax Calculators: Ultimate Guide

Introduction to Pennsylvania Salary Tax Calculators

Pennsylvania salary tax calculators are essential tools for individuals and businesses to calculate the amount of taxes owed to the state. With various tax rates and deductions, it can be challenging to determine the exact amount of taxes owed. In this article, we will explore the top 10 Pennsylvania salary tax calculators, their features, and how they can help individuals and businesses navigate the complex tax landscape.

Why Use a Pennsylvania Salary Tax Calculator?

Using a Pennsylvania salary tax calculator can help individuals and businesses save time and money by accurately calculating their tax liability. These calculators take into account various factors, such as gross income, filing status, and number of dependents, to provide an estimated tax liability. By using a reliable tax calculator, individuals and businesses can avoid penalties and fines associated with underpayment or overpayment of taxes.

Top 10 Pennsylvania Salary Tax Calculators

Here are the top 10 Pennsylvania salary tax calculators, along with their features and benefits: * TurboTax: Offers a comprehensive tax calculation tool with free filing options for simple returns. * H&R Block: Provides a tax calculator with a user-friendly interface and audit support. * TaxAct: Offers a free tax calculator with import options for W-2 and 1099 forms. * Credit Karma: Provides a free tax calculator with credit monitoring and financial tools. * Pennsylvania Department of Revenue: Offers a tax calculator with state-specific tax rates and deductions. * TaxSlayer: Provides a tax calculator with free filing options for simple returns and audit support. * FreeTaxUSA: Offers a free tax calculator with import options for W-2 and 1099 forms and audit support. * 1040.com: Provides a tax calculator with free filing options for simple returns and import options. * E-file.com: Offers a tax calculator with free filing options for simple returns and audit support. * TaxHawk: Provides a tax calculator with free filing options for simple returns and import options.

How to Choose the Best Pennsylvania Salary Tax Calculator

When choosing a Pennsylvania salary tax calculator, consider the following factors: * Accuracy: Look for calculators that provide accurate calculations and up-to-date tax rates. * Ease of use: Choose a calculator with a user-friendly interface and clear instructions. * Features: Consider calculators that offer import options, audit support, and free filing options. * Cost: Compare prices and free filing options to find the best value for your needs.

📝 Note: Always review and verify the accuracy of your tax calculations before filing your return.

Tips for Using a Pennsylvania Salary Tax Calculator

To get the most out of a Pennsylvania salary tax calculator, follow these tips: * Gather necessary documents: Collect your W-2, 1099, and other tax-related documents before using the calculator. * Enter accurate information: Ensure that you enter accurate and up-to-date information to get an accurate calculation. * Review and verify: Review your calculations and verify the accuracy of your tax liability before filing your return.

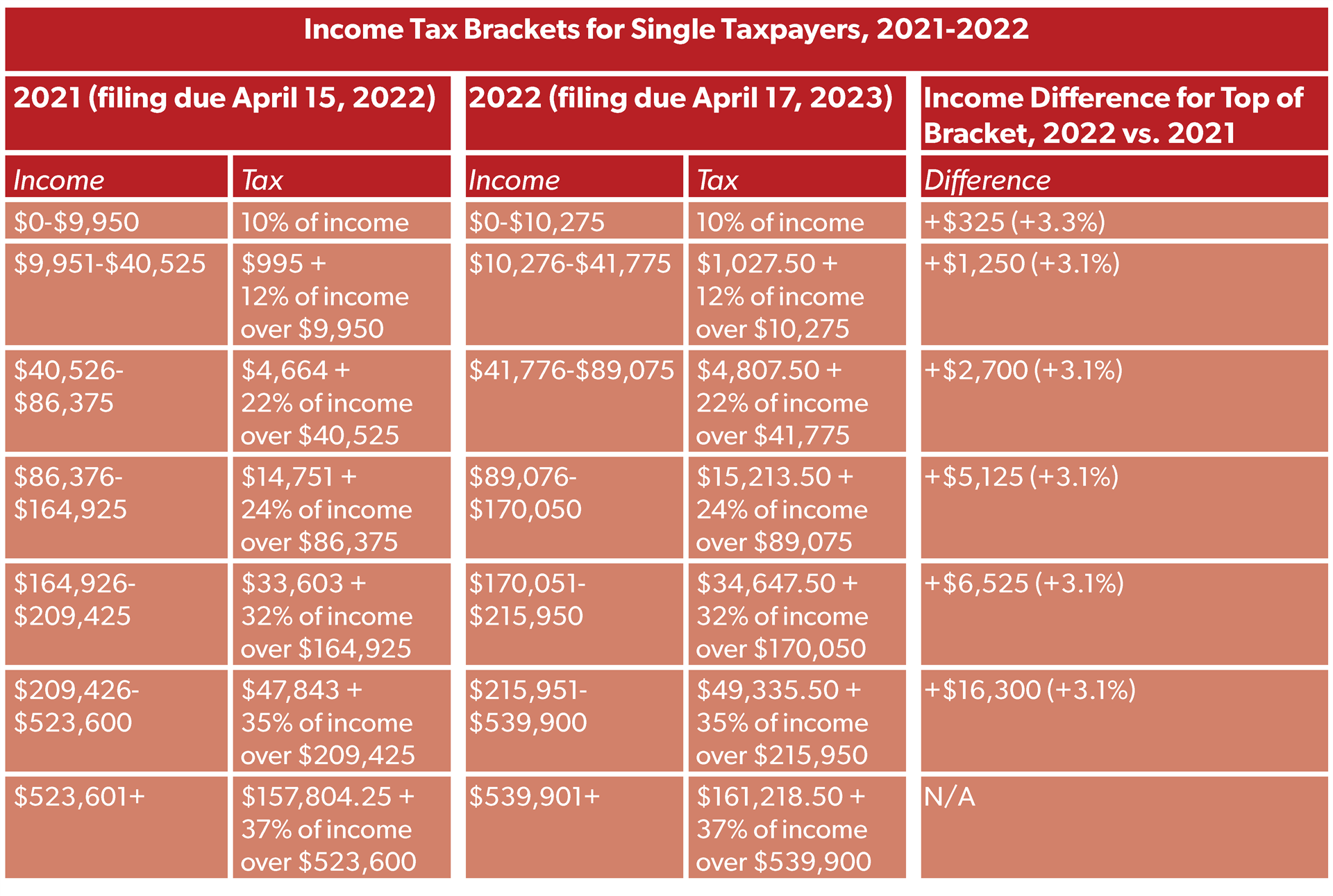

Pennsylvania Tax Rates and Deductions

Pennsylvania has a flat state income tax rate of 3.07%. However, there are various deductions and credits available to reduce your tax liability. Some of the deductions and credits include: * Personal exemption: A deduction of 4,020 for single filers and 8,040 for joint filers. * Standard deduction: A deduction of 12,000 for single filers and 24,000 for joint filers. * Earned Income Tax Credit (EITC): A credit for low-income working individuals and families. * Child Tax Credit: A credit of up to $2,000 per child for qualified families.

| Tax Filing Status | Standard Deduction |

|---|---|

| Single | $12,000 |

| Joint | $24,000 |

| Head of Household | $18,000 |

In summary, Pennsylvania salary tax calculators are essential tools for individuals and businesses to navigate the complex tax landscape. By choosing the right calculator and following the tips outlined above, you can accurately calculate your tax liability and save time and money. Remember to review and verify the accuracy of your calculations before filing your return, and take advantage of the various deductions and credits available to reduce your tax liability.

What is the Pennsylvania state income tax rate?

+

The Pennsylvania state income tax rate is a flat rate of 3.07%.

What are the standard deductions for Pennsylvania state income tax?

+

The standard deductions for Pennsylvania state income tax are 12,000 for single filers and 24,000 for joint filers.

Can I use a Pennsylvania salary tax calculator to file my return?

+

Some Pennsylvania salary tax calculators offer free filing options for simple returns. However, it’s essential to review and verify the accuracy of your calculations before filing your return.